Is the new government reducing tax on rental properties to benefit landlords or to cut the cost of rents? That’s the big question this week, after Associate Finance Minister David Seymour announced on Sunday that the Government would be reversing the Labour Government’s removal of the ability of landlords to write-off mortgage interest payments on their rentals. The policy will cost about $3bn over the next four years and is seen by opponents as a big cash handout to wealthy property investors.

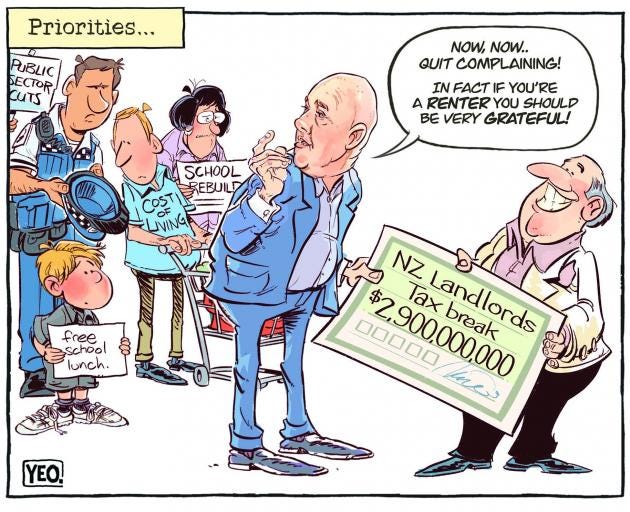

Prime Minister Christopher Luxon is selling the $3bn tax cut as addressing housing affordability for tenants, saying “This is all about improving life for renters”, and they’ve done it “because we care about renters in New Zealand”. He asserts that renters will be feeling “very grateful” that the Government is reducing costs for landlords that will be passed onto them.

But will it really? The issue is complicated, and there’s no clear consensus about what has driven the policy. There is, however, some agreement that the change will push up the value of houses in general, and as an unintended consequence it will be harder for first-home buyers to enter the market. Regardless, it’s also clear that the tax deductibility change is not going to make any huge difference to the status quo in which housing is still one of the biggest problems in New Zealand for those struggling with the cost of living.

The history of landlord tax deductibility

There’s some logic in landlords expecting to be able to write off their interest payments. Every other business can effectively do the same thing – they only pay taxes on their profits, and in working out any profits they deduct their costs (including interest charged by banks) from their revenue. And historically, landlords have been able to do this too in New Zealand.

Arguably, however, the housing market isn’t any normal business activity. Therefore, as the housing affordability crisis worsened during the last Government, a decision was made in 2021 by Labour to remove the ability of residential landlords to deduct interest payments in calculating their tax. Labour’s primary reason for this was to make rental investments less attractive, therefore slowing down the purchase of houses by landlords, with the hope that this would slow house price growth.

The parties of the right opposed this change at the time, with many calling it a “new tax”. It’s not surprising that they then campaigned to reverse this at the 2023 election and are now fulfilling the promise in office.

There have been some changes to the details of how Labour’s policy is being reversed. At first, the new Government announced that the policy was going to be retrospective, meaning that landlords would have been able to claim deductibility for the 2023 financial year. But after some consideration – especially around the immediate cost of this to the Government’s coffers – it was announced on Sunday that the new policy would not start being introduced until this year, when landlords could start deducting 80 per cent of their interest costs, and then 100 per cent in 2025.

Costs have changed considerably, too. The policy is now going to be about $200 million per year more expensive than what National originally budgeted for and promised in their election campaign.

Will tax deductibility help tenants?

The new Government is pitching the change as being about helping tenants with more affordable rent at a time when charges have been skyrocketing. Luxon points out that the average rent rose $170 under the Labour Government, and argues that part of this was due to the 2021 policy of removing tax deductibility, which loaded greater costs onto landlords.

No one from the Government is saying that the removal of tax deductibility will reduce the average rent, but instead that it will help put “downward pressure” on rents. For example, David Seymour says that the average rent “will be lower than it would otherwise be” – see the RNZ report by Lauren Crimp: No way renters will benefit from mortgage tax reductions – budgeting advisor

Seymour is also reported in this article forecasting that in cash terms the additional money going to landlords would result a “pretty even split” with tenants. So, for a situation in which an “owner of a $750,000 property with a $500,000 mortgage could expect to see about an extra $160 a week”, about $80 of that might end up in the tenant’s pocket in what might have been rent.

Kelvin Davidson, the chief property economist for CoreLogic, is also reported to agree that some of the lowered tax costs of landlords might trickle down to tenants, but that more significantly, a flood of demand for rentals would push prices much higher: “We've got a lot of demand for rental property, migration is very, very high… So, yes some landlords might pass cost savings on, but there's just wider forces at work here. High migration is putting pressure on the rental stock, and that's a big upwards driver of rents.”

Economist Tony Alexander argues today that the tax change is not likely to make much difference to rents, saying that the 2021 change also didn’t make much difference: “it is hard to find evidence that progressive removal of this deduction ability caused much extra upward pressure on rents” – see: Don’t expect landlords to lower their rents

Alexander points to many other escalating costs for landlords: “Council rates are soaring with increases casually bandied about of 15% - 25% and more… Insurance costs are also soaring with increases this year of around 30% for most people… For landlords these cost escalations mean scope for cutting rents is minimal and pushing rents higher will inevitably continue.”

For another good survey of economists’ reactions see Miriam Bell’s article in The Post: Interest deductibility is back, but no rent cuts for tenants (paywalled).

For example, property economist Ed McKnight of Opes Partners says: “The change is going to be positive for tenants over the coming years, but there won’t be much immediate change.” He also forecasts, like others, that the tax change will result in more investment in rental properties.

Renters United spokesman Luke Somervell also predicts a “feeding frenzy” for property speculators, making no real difference: “It's just going to prop up the status quo that's given us the housing crisis in the first place” – see RNZ’s report, which also includes the plaudits from representatives of landlords – see: Landlords praise tax deduction on rental properties

The political influence of landlords

The maxim that capitalists “want to socialise their losses and privatise their profits” seems fit for this example of landlords who have lobbied the parties of the right to allow them to write off their mortgage interest costs in their tax bills.

To those on the left, much of this looks like corporate welfare – the use of taxpayers’ money to help businesspeople. And because it comes at a time of austerity, when the new Government is cutting back on all sorts of government programmes and agencies, it looks like favouritism is being displayed towards the wealthy.

There’s a certain amount of cynicism from those on the left. One activist (@AaronIncognito) posted on X, that the policy is just one part of a continued pattern: “Of course the ski fields got a bailout; Of course landlords got a handout; Of course the PM got 1k a week to live in his own house; Of course there's no money to feed the hungry schoolkids”

Another activist (@Liquid_Times) drew attention to other apparent subsidies that landlords get from the state: “Hardworking Kiwis are already pumping $2 billion per year into the pockets of landlords via the accommodation supplement. Why do landlords need tax cuts on top of this? And if we get more landlords we'll be paying more in tax to pay for more accommodation supplements. Bonkers.”

The last point is a particularly good one in terms of the property industry, because the state’s accommodation supplement has a particularly big impact on demand and supply of private rentals. That $2bn per year helps pay a lot of rent, subsidising landlord investments and pushing up the price of housing. And it’s a lot of money that can’t then be spent in other parts of the welfare state, which embeds the status quo in general.

Negative political optics for the new Government

The National-led Government has ended the week looking like it’s pro-landlord. The public can now look at the three parties of government and assume that they have just helped their “rich property-owning mates”, who vote for those parties and possibly donate as well. It all looks like a suspicious case of quid pro quo politics in action.

It’s also the “prioritisation issue” that will have a big number of voters – including many who voted last year for the parties of government – wondering whether the new administration has decided to forgo about $800m a year in lieu of other worthy causes, including balancing the budget. At a time of severe fiscal austerity, there will be questions about why landlords get a big tax cut when various government services are underfunded. And in the future, whenever cuts are made to programmes like lunches in schools, there will be a suspicion that such victims are a direct result of landlords getting a big payout.

For an example of this, see 1News’ Cuts to public services as landlords await a $2.9b tax break. In this, the handouts are contextualised: “Meanwhile, everything from free school lunches to school rebuilds were being reviewed as ministries faced financial pressures, with wheelchair users among those feeling increased uncertainty.” Furthermore, journalist Max Rashbrooke is reported criticising the prioritising of property tax cuts: “It's probably not going to lead to lower rents; it's not going to build more houses; and, at the same time, it's been funded by making life harder for people on benefits.”

The Government will also be even more vulnerable in terms of MPs’ own rental ownerships. As we saw with the mini-scandal over Luxon’s entitlement to his accommodation supplement, there’s a new public sensitivity to politicians being perceived to be on the take from politics. Of course, many MPs are landlords, and will benefit from these new tax cuts. Luxon himself has been questioned this week about this. RNZ reported on this yesterday: “Asked if he would decrease the rent at his own properties, he said he would not be benefiting from the change. This is because Luxon has no mortgage on any of his seven properties” – see: PM Christopher Luxon argues renters will be 'grateful' for interest deductibility change

Ultimately, however, the biggest impact on the Government’s popularity on this issue will come from whether the unaffordable housing market is fixed or not. And the consensus seems to be that regardless of whether allowing interest deductibility helps or hinders the fight to improve housing affordability, it won’t make a big difference either way. Masses of new homes won’t suddenly get built as a result. The status quo that has existed for the last two decades looks likely to continue, and the trend continues of New Zealand becoming a country of renters.

Dr Bryce Edwards

Political Analyst in Residence, Director of the Democracy Project, School of Government, Victoria University of Wellington

This article can be republished for free under a Creative Commons copyright-free license. Attributions should include a link to the Democracy Project (https://democracyproject.nz)

Cartoons today

Please share this email newsletter with others. Anyone can subscribe, for free, by clicking on the button below.

Landlords should be able to deduct interest from taxable income, but only if they also pay capital gains tax. In the absence of a capital gains tax renting houses is not "just like any other business". I am amazed that people don't recognise the idea that this $3 Billion handout will result in lower rents as just another version of the tired old "trickle down" argument. Margaret Thatcher, Roger Douglas, and Ruth Richardson couldn't have stated it more clearly.

Good article. Perhaps to be consistent, landlords should be able to deduct interest. But the same argument for cutting GST from some food -as takes place in every developed nation to some extent and is lambasted by pundits here, is what is used to justify cutting the tax deductibility and shortening the bright line. Landlords, like grocery chains, will keep the profits. Albeit a well-oiled grocery commission could have overseas such ill-gotten windfall gains.

In most of the developed world, rent controls, stamp taxes, capital gains and/or wealth taxes slow down housing speculation and tax the wealthy. Here they are off Scott-free paying taxes on income-producing assets such as housing. As has been written many times - “Today's research shows the wealthiest New Zealanders pay on average 9.5% tax, including GST, on their economic income. Meanwhile, someone with a salary of $80,000 pays around 28-29% of their economic income, including GST.” It is embarrassing.

And National who built 90 homes during their 9 year tenure last time pale compared to Labour who built over 13,000 homes resulting in the worst homelessness in the developed world by 2017. But that is another story.

“Spain capped energy prices by more than the UK, lowered the cost of public transport, taxed excess profits and put in place limits on how much landlords can raise rents.” Its inflation fell to less than 2% last year and its economy is growing by over 2.5%. https://www.theguardian.com/commentisfree/2023/aug/03/spain-inflation-lower-bank-england-interest-rates So let’s dispense of the neo-liberal model that has been shown to have failed for over 40 years.